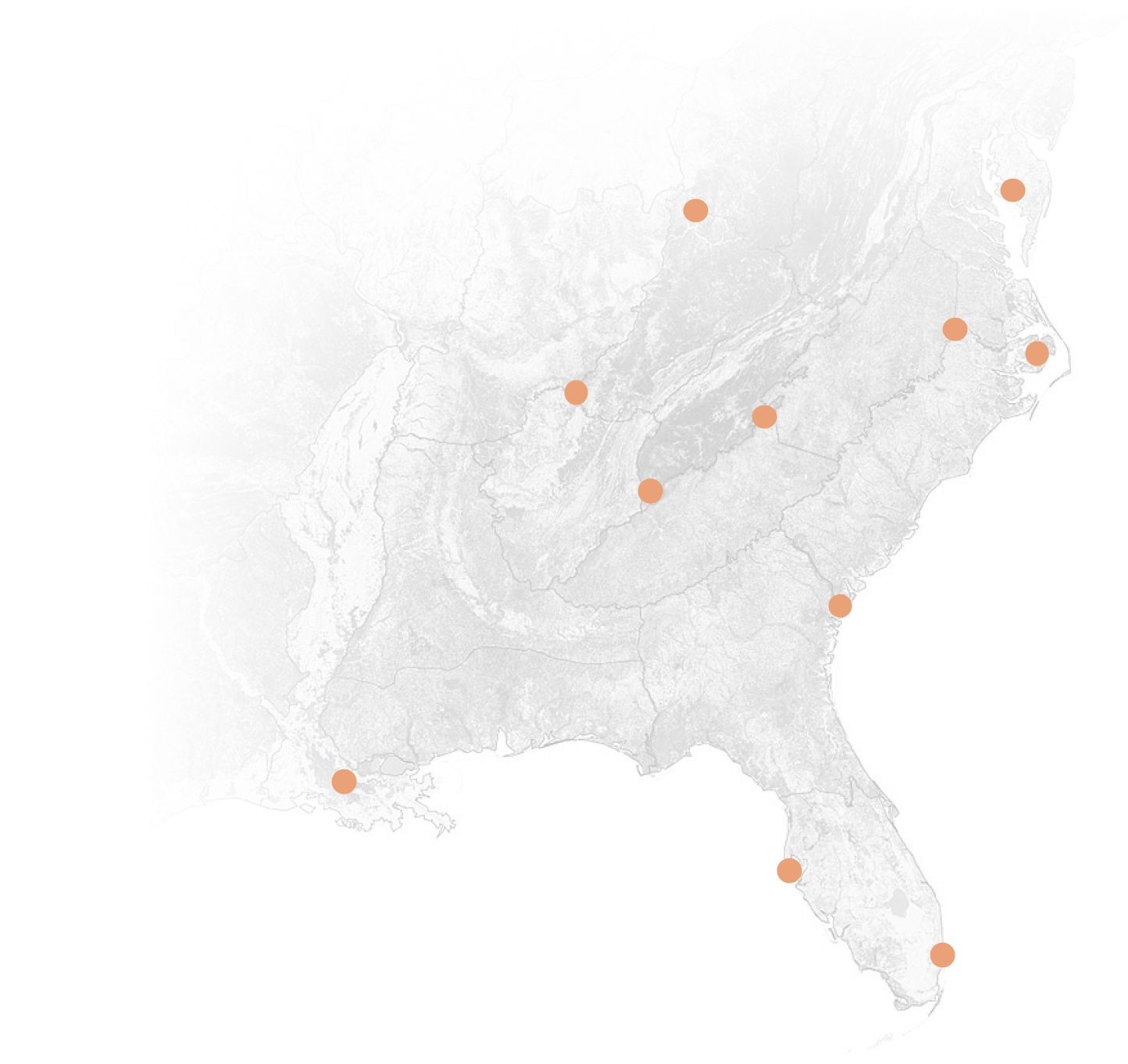

Similar to the largest and most sophisticated institutions, we invest in both venture funds and startups -- but our focus is the Southeast.

Hybrid Investment Model

Southeast Focus

Purpose-Built

Collaborative Approach

Dispersion is real and diversification helps

28.1%

25-year US venture capital returns

Venture outperforms other assets over the long-term and the best performing institutions historically to continue to hold their overall 20-30% allocation to venture (even post-COVID)

7.9x

VC returns dispersion compared to US small cap public equities

Power law in venture creates massive returns dispersion, and conquering low dispersion in the public markets is very different than in venture capital

~500

Startups contained in a truly diversified venture portfolio

Higher dispersion requires more diversification -- but building a portfolio of 500+ startups is ONLY typically available to large institutions

Our portfolio is anchored by a curated selection of the best fund managers in the Southeast

Focus on category leadership

Cast a wider, high quality net

Maximize quality deal flow

Protect against the downside

Our fund partner network provides differentiated insight that helps us chase upside with direct startup investments

Maximize upside

Build early ownership

Facilitate direct LP access

Our startup primordial ooze is primed and ready

22%

Southeast share of US GDP

Historically the region has accounted for <10% of venture investment, but that share is now steadily increasing toward GDP parity

40%

Share of US population

The Southeast is the largest and fastest growing economic region in the country and home to 10 of the 15 fastest-growing large cities

50%

Of America's Top-10 States for Business (2024)

The Southeast is home to 5 of CNBC's top-10 States for Business given relatively low cost and friendly tax/business environment

Catalyzing tech growth in the Southeast through strategic startup and fund investments